Walmart’s fiscal year 2023 (ending January 31, 2024) painted a picture of a retail giant navigating a dynamic economic landscape. Here’s a comprehensive analysis that builds upon the previous points and sheds light on key areas:

Revenue Growth Engine

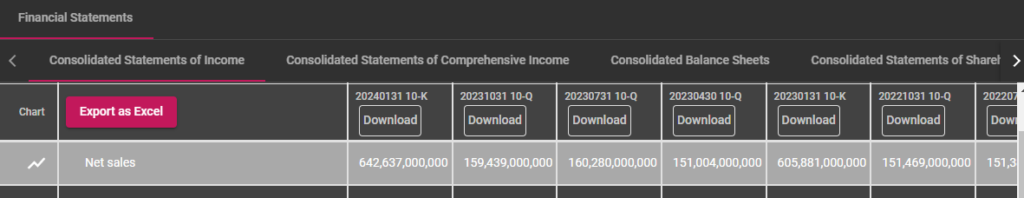

Walmart’s impressive 7.3% year-over-year revenue growth to $611 billion signifies their ability to capture consumer spending. This growth was broad-based, with all three segments – U.S., International, and Sam’s Club – contributing positively. The U.S. segment, their largest, remained the powerhouse, generating nearly 70% of total revenue. This dominance highlights Walmart’s deep understanding of the American consumer and its effectiveness in fulfilling their needs.

Profitability Under Scrutiny

While readily available data doesn’t reveal the full picture of FY 2023 net income, there are indications of fluctuations in earnings compared to the prior year. Walmart’s quarterly reports showed some decline in operating margins, dipping to 3% from 5% in FY 2022. This could be due to several factors, including rising supply chain costs, increased wages to attract and retain employees, and promotional pricing strategies to stay competitive. A closer look at the annual report, once available, will be necessary to pinpoint the exact reasons behind the profit margin shift.

E-commerce: A Growth Imperative

Walmart’s e-commerce performance is a crucial metric for future success. While they boast a growing online presence with $82 billion in sales for FY 2023, this figure represents only 13% of total revenue. Compared to Amazon, a dominant force in online retail, Walmart has significant ground to cover. Analyzing their e-commerce growth rate, customer acquisition strategies, and fulfillment infrastructure becomes vital. Are they effectively leveraging online grocery delivery and pickup options? How are they personalizing the online shopping experience to compete with the likes of Amazon and Target?

The Competitive Landscape

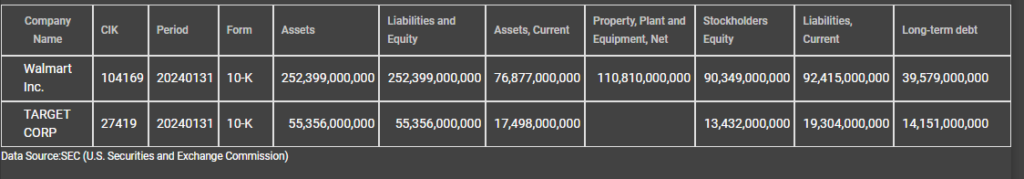

Walmart faces relentless competition from established players like Amazon and Target, as well as from discount grocers like Aldi. Assessing Walmart’s strategies in product assortment, pricing tactics, and store experience is essential. Are they successfully differentiating themselves through private label brands or exclusive product offerings? How are they optimizing store layouts and staffing levels to enhance customer convenience? Additionally, monitoring the rise of new retail models and consumer preferences becomes vital in this ever-evolving landscape.

Macroeconomic Headwinds

Walmart’s performance is also susceptible to broader economic factors. Inflationary pressures, rising interest rates, and potential shifts in consumer spending habits can significantly impact their bottom line. Analyzing how effectively Walmart is managing these headwinds through cost-cutting measures, inventory control, and dynamic pricing strategies is crucial.

Conclusion: A Strategic Balancing Act

Walmart’s financial picture for FY 2023 reveals a company navigating a complex environment. While they demonstrate impressive revenue growth, profitability remains under scrutiny. Their success hinges on their ability to:

- Solidify their e-commerce presence: Growing online sales and effectively competing in the digital space are paramount.

- Sharpen their competitive edge: Differentiating themselves through product offerings, pricing strategies, and customer experience is essential.

- Navigate macroeconomic challenges: Adapting to inflation, interest rates, and evolving consumer behavior requires agility and strategic planning.

By delving deeper into the annual report and closely monitoring these focus areas, you can gain a richer understanding of Walmart’s long-term financial health and its potential to thrive in the ever-changing retail landscape.